Bitcoin and Ethereum are holding steady, but derivatives data shows traders quietly raising their exposure.

Bitcoin (BTC) and Ethereum (ETH), the two largest cryptocurrencies by market value, traded in a narrow range on Friday. Prices barely moved, but activity in futures and perpetual markets suggests traders are taking on more risk.

DISCOVER: Best New Cryptocurrencies to Invest in 2025

Bitcoin Price Prediction: Can BTC Hold Its Weekly Structure if Volatility Picks Up?

According to CoinGecko. BTC is trading near $93,000, a small +0.4% gain on the day.

Bitcoin’s 24-hour spot volume is above $52Bn, showing that liquidity remains strong even as the market pauses near recent highs.

Data from DeFiLlama shows about $39.51M in BTC perpetual volume on Bitcoin-based protocols over the past day.

The numbers point to a market that isn’t moving much on the surface but is building leverage underneath.

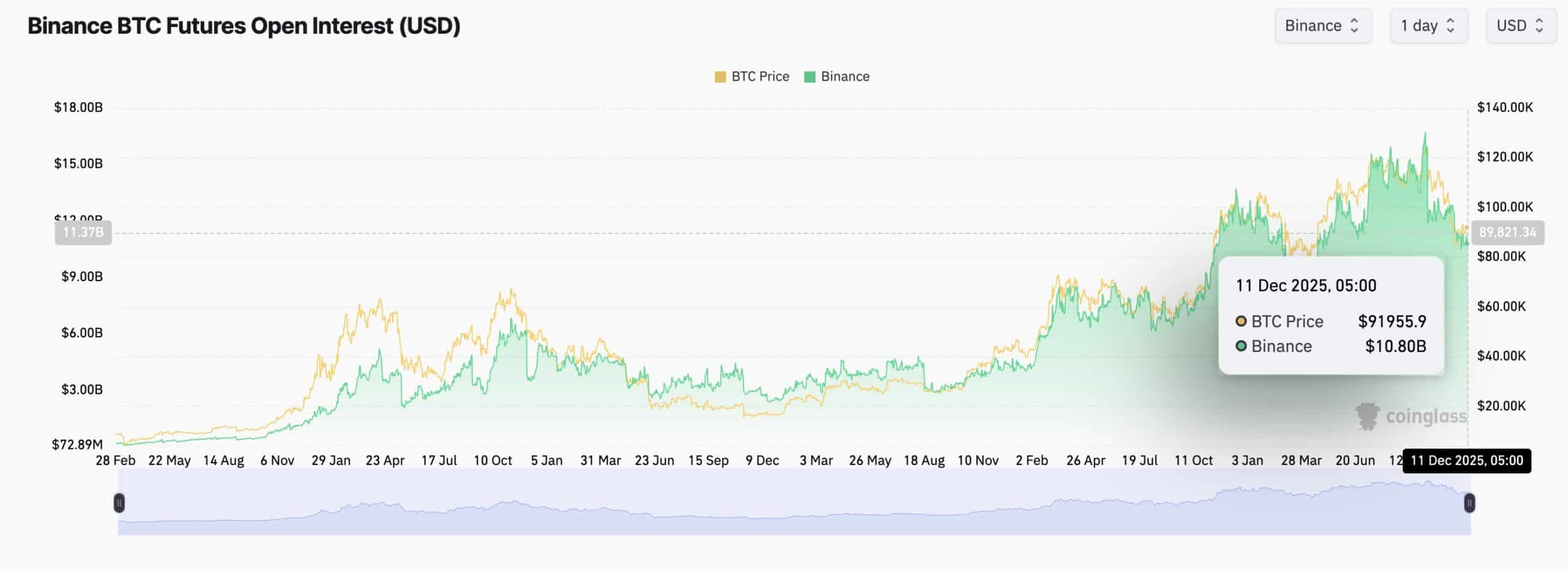

CoinGlass puts Bitcoin’s Binance futures open interest near $10.80Bn. That’s only a small lift from the day before, which shows traders are steady and not chasing risk ahead of the next big macro event.

Bitcoin is still holding above a key support zone after reacting cleanly to the 0.382 Fibonacci retracement.

This level comes from the full cycle move and is the same point highlighted in Daan Crypto’s chart.

The weekly structure is still intact. Price bounced near $84,000, which he marked as the lowest BTC could drop without breaking its broader trend.

His chart also outlines higher-timeframe Fibonacci zones that have shaped the market since early 2023. The latest rebound shows buyers are still defending this cycle’s structure.

Daan said “BTC this time has not proven itself to be any different… Good initial bounce from that .382 level.”

He also warned that a move “below November’s lows would make for a scary place to be for the bulls.”

DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2025

Ethereum Price Prediction: Can ETH Hold Above Key Support After the Reversal Signal?

CoinGecko data shows that ETH is currently trading at around $3,250, following a roughly 3% rise.

Ethereum is showing a sharper move today. Its 24-hour trading volume is close to $ 31.7 billion, and the stronger price action suggests that buyers have returned after a short period of consolidation.

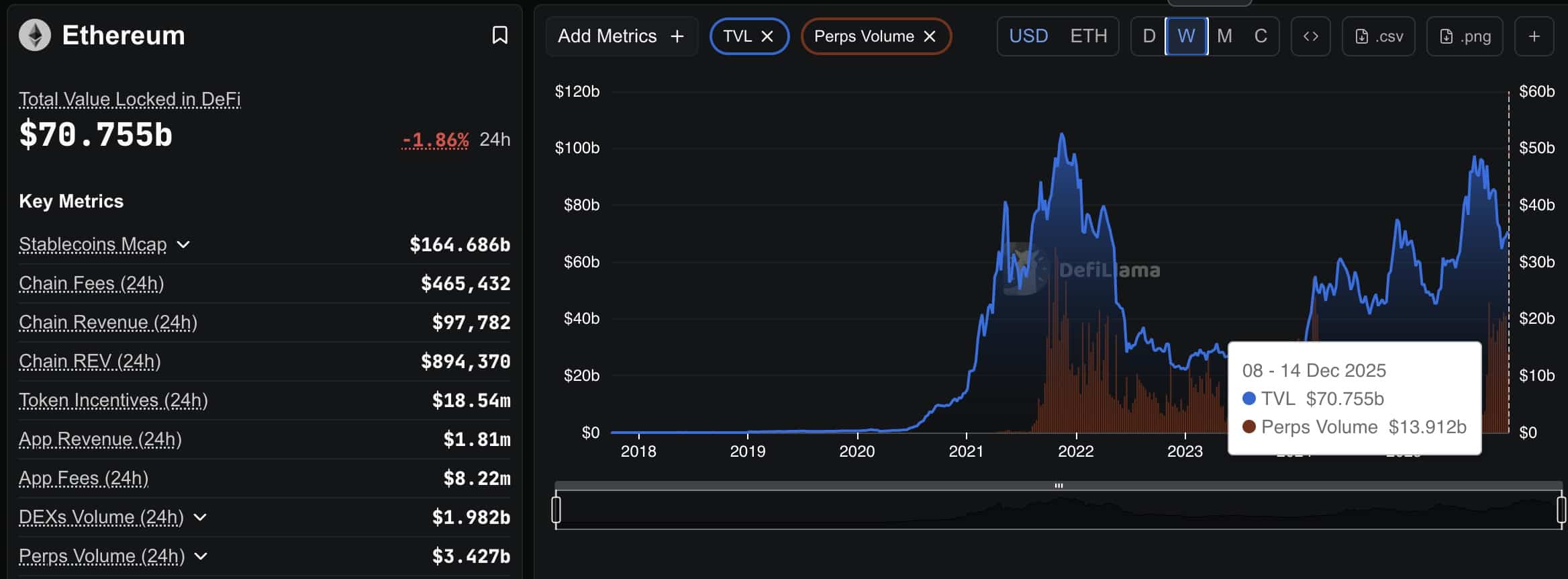

Derivatives activity on Ethereum is also picking up. Perpetual futures on the network handled about $3.4Bn in volume over the past day, with open interest around $180M.

According to DeFiLlama data, weekly perp activity is up more than +15%.

That signals a clear shift, as traders are once again taking leveraged positions on the leading smart-contract asset.

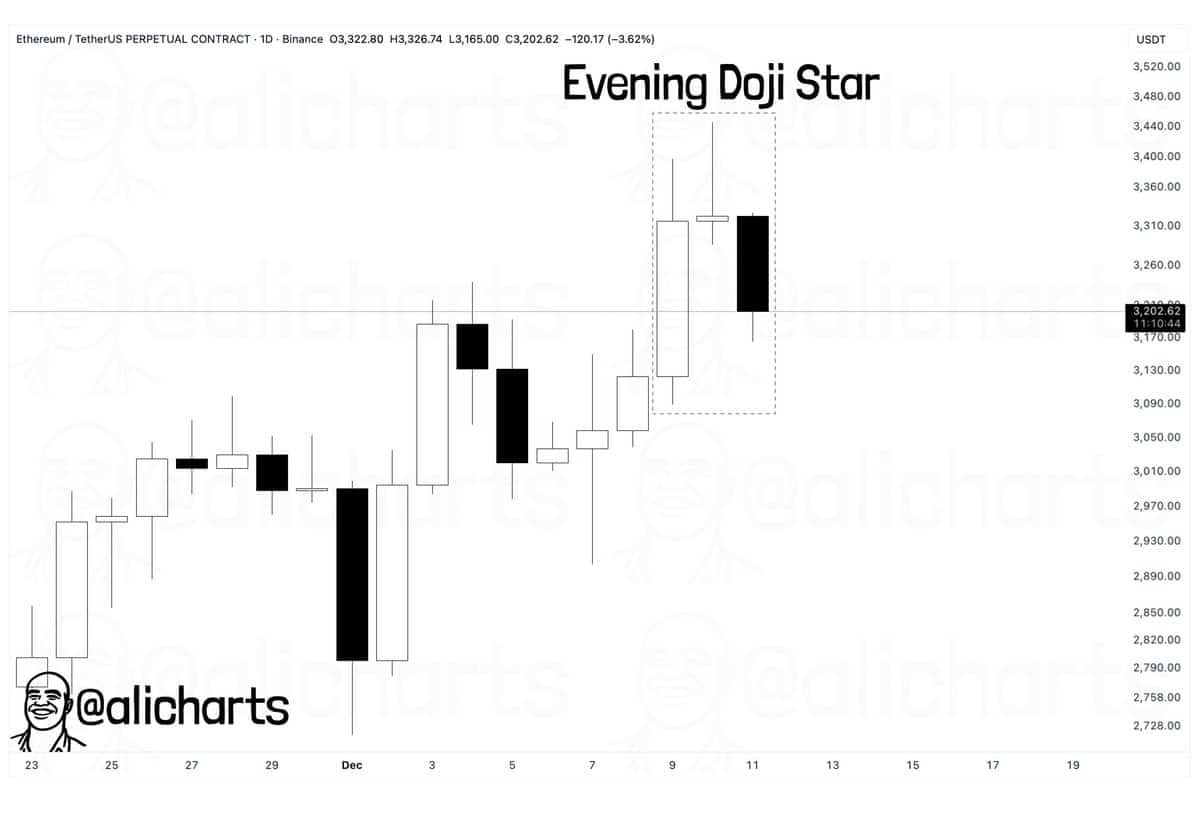

Ethereum pulled back after flashing a possible reversal signal on the daily chart, adding a cautious tone to its recent climb.

Analyst Ali Martinez shared a chart showing an evening doji star, a pattern that often forms near short-term tops and hints that buyers may be losing strength.

The chart shows ETH pushing into the $3,320–$3,350 area before momentum faded. A doji candle appeared at the top of the move, showing hesitation.

The bearish candle that followed made the shift clearer, as sellers stepped in after several steady sessions of gains. If ETH cannot hold support around $3,170, the move could slip into a short corrective phase.

“Ethereum may be printing an evening doji star, a sign that momentum could fade,” Martinez said.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

The post Bitcoin and Ethereum Price Prediction: Will BTC’s Weekly Structure and ETH’s Reversal Signal Hold Under Growing Market Risk? appeared first on 99Bitcoins.