Thanks to Bitcoin’s volatile price and speculative nature, those unfamiliar with Bitcoin typically view it as an investment vehicle rather than a currency.

In fact, out of the nearly 359 million businesses worldwide, only 15,000 accept bitcoin as payment and it is estimated that only about 2-3% of adults worldwide have used bitcoin in a business transaction. So, what is bitcoin’s biggest obstacle to becoming a widespread currency?

Dhruv Bansal

Cofounder of Unchained Capital

“Knowledge. Most people just don’t know enough about it. As they learn more about it they’ll come to adopting it.“

The lack of understanding surrounding Bitcoin is one of—if not the strongest—reasons why it is not commonly used as a currency. It’s simple, if you don’t understand it, you’re not going to use it, that goes for both consumer and producer.

If a business owner doesn’t understand bitcoin, they’re not going to accept it as payment. If the consumer doesn’t understand bitcoin, they’re not going to see any reason to pay with it.

Simple as that. Humans tend to stick with what they know and avoid what they don’t know. People know the traditional monetary system and continue to use it because that’s what they know.

People don’t know Bitcoin and therefore they avoid it. The primary reason bitcoin isn’t used as a widespread currency is because most people don’t know enough about it.

Daniel Wingen

Co-Founder/CEO of Tidebinder & Vice Chairman of Bitcoin Bundesverband

“Most people do not take Bitcoin seriously as money because they cannot use it where they already shop. If you cannot pay with bitcoin at your favorite stores, restaurants, or online services, why would you bother using it at all? It feels impractical, so most people ignore it.”

“This is not a technology problem. The Lightning Network makes bitcoin payments instant and cheap. The real challenge is adoption.”

“Businesses are hesitant to accept bitcoin, and as long as they do not, people will keep seeing it as an investment rather than real money. Until that changes, bitcoin will remain on the sidelines of everyday payments.”

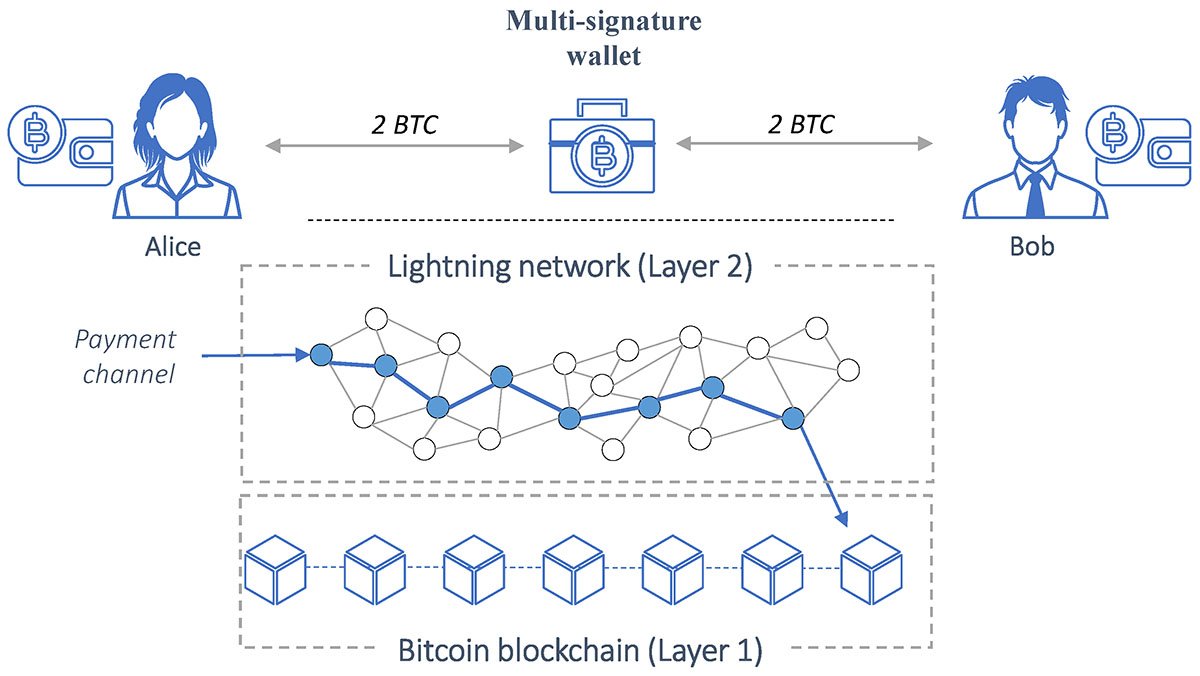

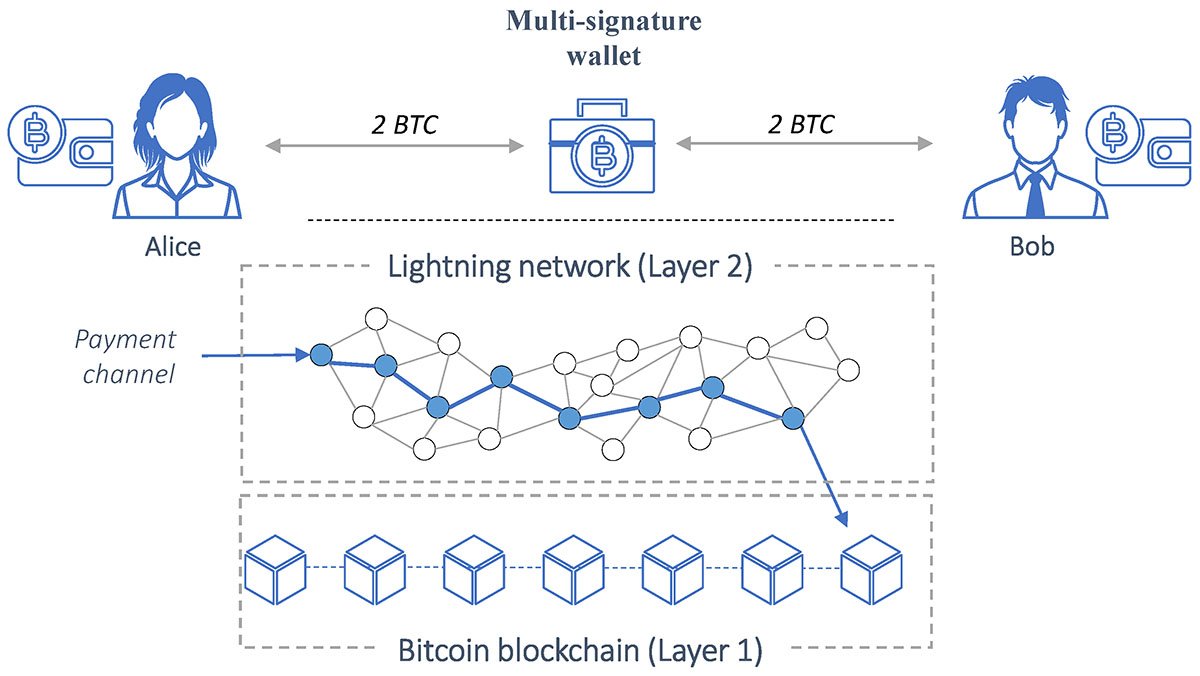

The Lightning Network is a layer-2 protocol designed to make Bitcoin transactions faster and cheaper by enabling off-chain transactions. In order to pay with bitcoin through the Lightning Network at a store the following needs to happen:

- The store sets up a Lightning wallet and a payment channel (this is recorded on the blockchain).

- The consumer deposits some bitcoin into their own Lightning wallet (this is recorded on the blockchain).

- At checkout, the store displays a QR code in which the consumer scans it using their Lightning wallet app.

- The bitcoin is sent from the consumer’s Lightning wallet to the store’s Lightning wallet. The transaction between the store and the consumer is done. This transaction is not recorded on the blockchain because it is a transfer between the two Lightning wallets.

The store can then close their payment channel by initiating closure with the payment processor. This is an automated process where both the store and payment processor sign the transaction with their private keys, effectively closing the payment channel.

When the payment channel is closed, the final settlement transaction (the final amount of bitcoin in the Lightning wallet) is broadcast to the blockchain and recorded on-chain.

The Lightning network allows for Bitcoin to be effective in small, daily transactions and allows for businesses to cheaply and easily adopt Bitcoin as a payment method. Being able to buy your daily coffee with the digital asset is a key step in the direction of bitcoin adoption.

Tali Lindberg

Founder of Orange Hatter Women Initiatives & Co-Founder of Free Market Kids

“They [young people] feel like it [the monetary system] is something so outside what they can affect that they don’t pay attention to it…Until people ask the question about our monetary system right now, they’re not going to see the value of Bitcoin no matter what you and I say, they think they’ve missed the boat.”

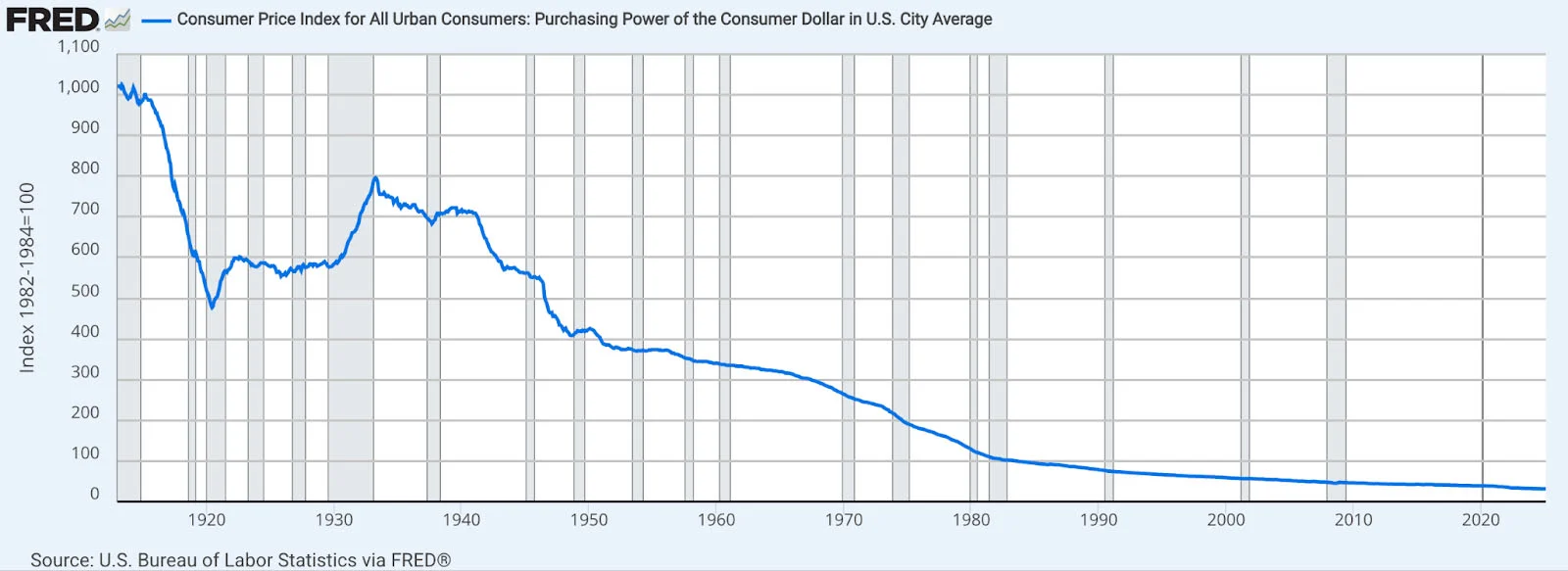

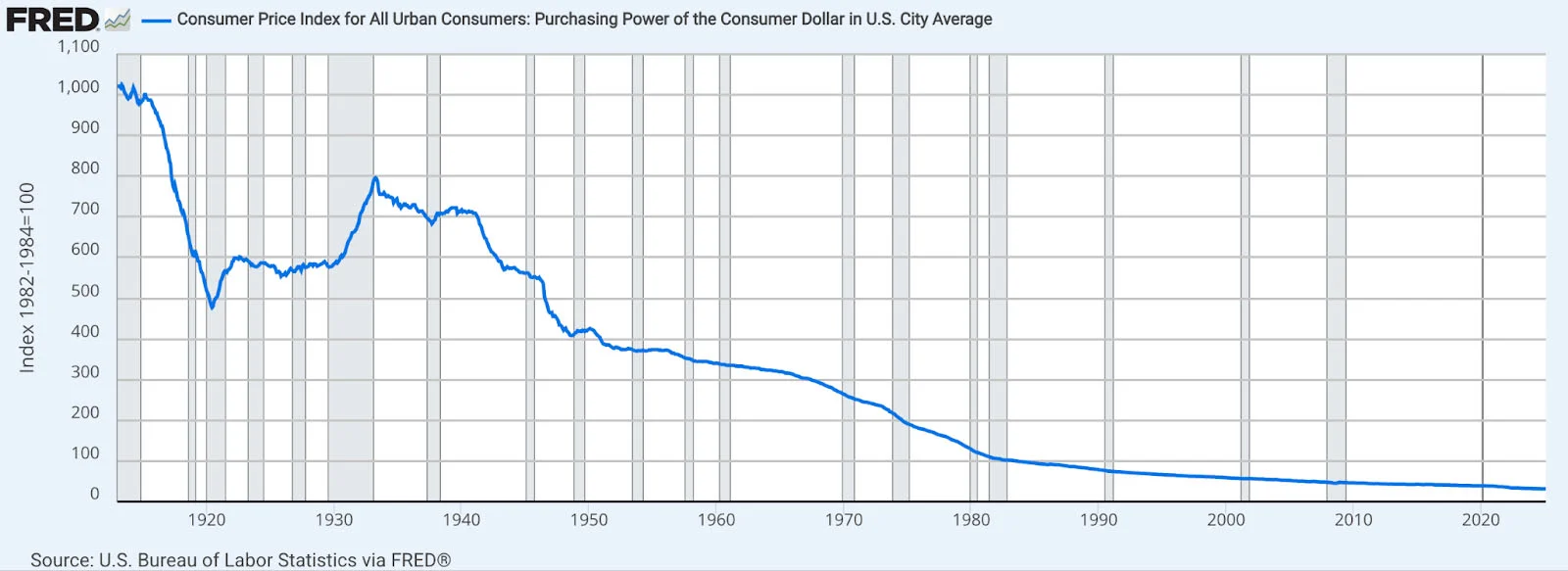

People don’t think about how the current monetary system affects them, because to them, it doesn’t seem like an immediate concern. However, since 2020 the purchasing power of the U.S. dollar has decreased by about 23%, meaning $1 in 2020 is worth $0.77 in 2025.

A $200 grocery trip in 2020 costs about $50 more in 2025. The average person is aware of inflation but they don’t realize just how much money they lose each year to it.

Until people begin to question if the current monetary system is really right for them, bitcoin will not become widely adopted as a currency.

Brett Garman

Founder & CTO of Guardrail Mining

“I think one of the biggest things holding bitcoin back from being used like everyday money is that it’s totally digital. You need electricity, an internet connection, and some kind of device to send or receive it.

“That’s a lot, especially compared to cash or even gold—you don’t need Wi-Fi to buy a sandwich with a $5 bill. So in places with bad infrastructure, or during blackouts or disasters, bitcoin becomes kinda useless.

“Another thing is just how different it is from what people are used to. It’s not physical, it’s not issued by a government, and you can’t stash it in a drawer. For a lot of people, that makes it feel less ‘real.’

“But honestly, governments are already in the process of adopting it—regulating it, taxing it, even holding it on balance sheets. That shift has already started. It’s just a matter of time now.

“Stuff like the Lightning Network is helping a lot—it makes Bitcoin faster and cheaper to use, and it might eventually help with offline payments too, even if we’re not quite there yet. There’s a ton of smart people working on that.

“So yeah, I’d say the biggest obstacle is that Bitcoin depends on the internet and electricity, and it’s just not as intuitive or tangible as the money people grew up with. But the pieces are falling into place. It’s still early.”

The intangibility of bitcoin is something that can be difficult for people to come to terms with. It can be difficult to shift from using tangible, paper money to intangible virtual money.

For a lot of people, the tangibility of paper money brings comfort and confidence in the system, as people tend to believe what they can see/feel. However, younger generations grow up already surrounded by technology and already use intangible things in their daily lives.

This can be seen through streaming services like Spotify and Netflix, where users have access to thousands of songs, movies, and shows without any DVDs or CDs involved.

Younger generations also have exposure to cloud storage (Google Drive & iCloud for example) at a younger age compared to USB drives and floppy disks.

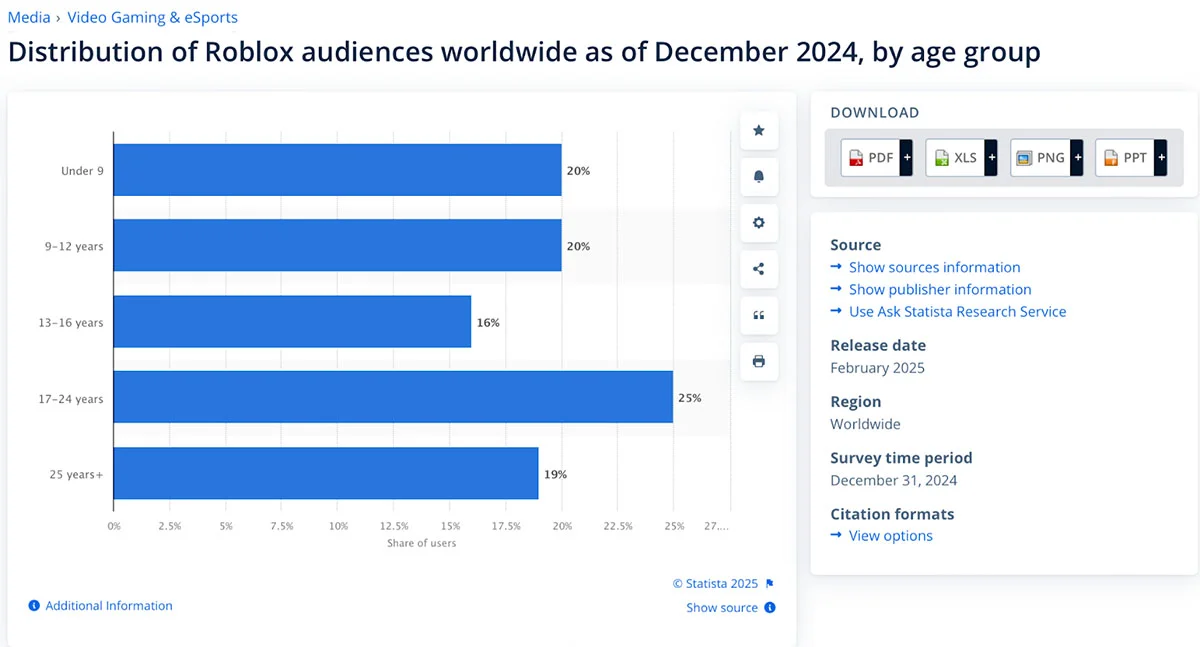

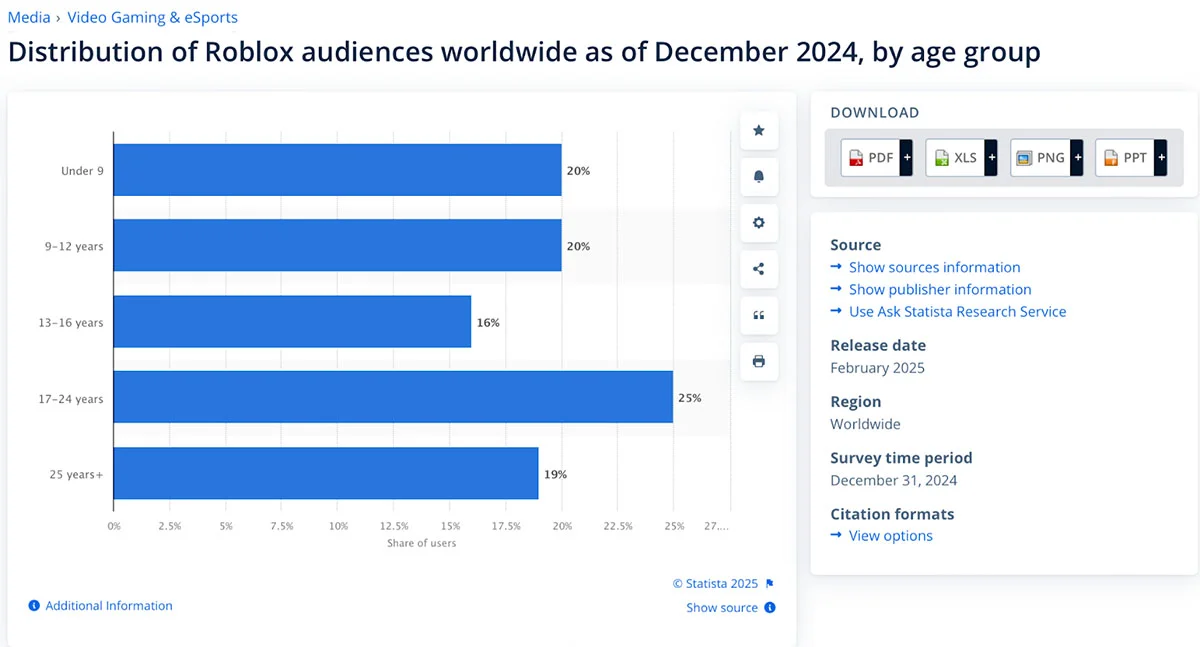

The in-game currencies of video games, such as Fortnite’s V-Bucks or Roblox’s Robux (two of the most popular video games for those under 25), are another example of intangibility in the lives of the younger generation.

They have a paradigm where they are typically more comfortable with the idea of intangibility than the older generations. As time progresses, more and more people will grow up on intangible technologies, allowing for people to more easily digest bitcoin’s intangible nature.

Bitcoin’s dependency on the internet & electricity will remain a big obstacle for adoption in less-developed countries.

There is really no concrete timeline for when all countries will have reliable infrastructure that can constantly support Bitcoin. The United Nations claims that by 2030 all people should have reliable internet access which would be a step in the right direction for Bitcoin adoption.

Hector Alvero

COO at Rhino Bitcoin

“The challenge is acceptability. If the places that represent the meaningful share of the places where you use currency do not accept that currency [bitcoin] then there’s no more reason for you to have sats in your pocket than there is to have euro in your pocket in the United States as an example.”

If the challenge is acceptability, what’s the solution? The answer is education. The more informed people are about Bitcoin, the more likely they are to use it.

Hector also commented on the solution, stating, “How do you get people to have more places in their life that accept Bitcoin and therefore makes it easier and creates more need for them to want to hold bitcoin and use it to pay for stuff? Well first you have to get people to accept it in the first place.”

Merchant-side education is a vital piece of overcoming the acceptability issue. People may want to pay in bitcoin but until someone is actually willing to accept it, the transaction can’t happen.

Bitcoin Adoption stalls at the point of payment, making education on the merchant side just as, if not more, critical as consumer awareness.

While Bitcoin has made significant advances in adoption since its creation, it has yet to reach its intended purpose—to regularly be used as a currency.

It still faces numerous obstacles to becoming widely adopted. The biggest one being lack of understanding—people won’t use what they don’t know. As awareness grows, bitcoin could shift from a speculative asset to a widely accepted currency.

Bitcoin won’t be used as real money until people stop seeing it as the money of the future—and start using it as the money of the today.