Oregon has officially signed Senate Bill 167 (SB 167) into law, making digital assets, including bitcoin, legal collateral in financial transactions.

Governor Tina Kotek signed the bill on May 7, updating Oregon’s Uniform Commercial Code (UCC) to allow the use of digital assets like bitcoin as collateral in secured lending.

It adds Article 12, which outlines the legal framework for “controllable electronic records” which includes digital assets, tokenized records and electronic money.

SB 167 says digital assets can be used just like traditional collateral. That means individuals and businesses can use bitcoin or other digital assets to secure loans or financial agreements.

Before this, there was a lot of uncertainty. Companies and financial institutions weren’t sure how bitcoin would fit into the law, especially when it came to using it in commercial contracts. Now SB 167 removes that doubt.

It also updates Article 9 of the UCC to allow digital assets such as bitcoin as collateral in secured transactions. It also recognizes electronic records, electronic signatures and hybrid transactions, opening up more blockchain-based business activity.

This gives important legal clarity which could encourage more institutional investors to enter and participate in the market with more confidence.

Oregon is now one of the first states in the U.S. to clearly define and support the use of digital assets in the legal and financial systems. Analysts say it could trigger similar moves across the country.

In fact, the momentum is already building. Arizona and New Hampshire have already passed significant bitcoin-related bills this week.

In Arizona, Governor Katie Hobbs received a lot of criticism after vetoing Bill SB 1025.

After that, she was presented with another bitcoin-related bill—House Bill 2749— which she did sign into law, creating a state-run “Bitcoin and Digital Asset Reserve.”

This new fund allows the state to take custody of unclaimed digital assets after 3 years of inactivity and use them to generate value through staking or airdrops.

Jeff Weninger, Chair of the Arizona House Commerce Committee, said, “Digital assets aren’t the future—they’re the present. We’ve built a structure that protects property rights, respects ownership, and gives the state tools to account for a new category of value in the economy.”

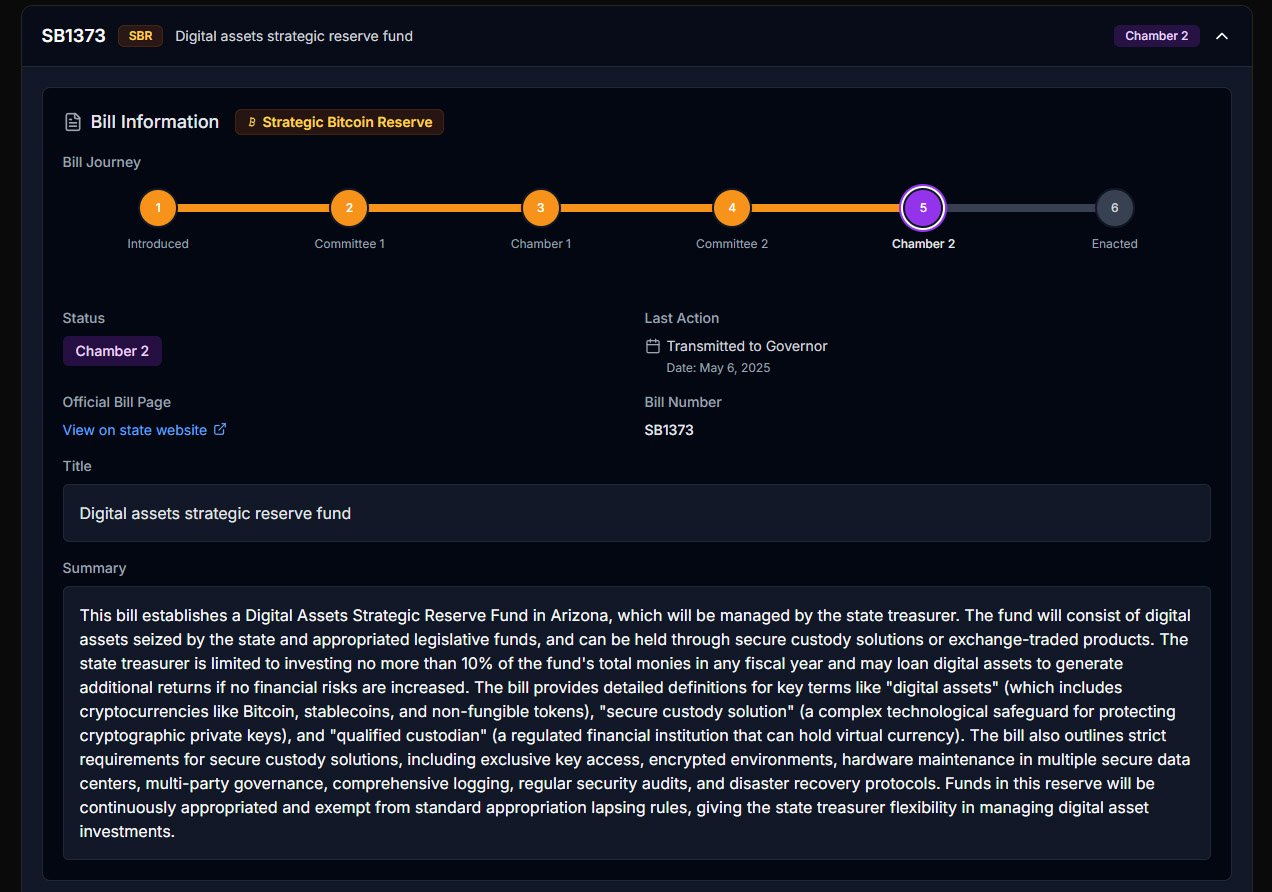

Arizona also has another bill, Senate Bill 1373, pending with the governor. If signed, it will allow Arizona’s treasurer to allocate up to 10% of the Budget Stabilization Fund into bitcoin, turning it into a strategic financial hedge.

And above all that, New Hampshire became the first state in the U.S. to legally enable the creation of a Strategic Bitcoin Reserve (SBR) thanks to House Bill 302.

These developments show that state governments are starting to take bitcoin seriously, not just as a speculative asset, but as part of the formal financial and legal system.

Another Oregon bill, House Bill 2071, has also been introduced.

It seeks to protect the rights of individuals and businesses to use digital assets for lawful payments and peer-to-peer transactions. Although still in early stages, the bill shows Oregon’s growing interest in blockchain and bitcoin innovation.