In the starting phase for many years, Ethereum has only been a capable competitor to Bitcoin and no doubt Ethereum has the second largest Market cap after Bitcoin. While that hasn’t really changed in key aspects, the digital assets ecosystem has grown by leaps and bounds.

The tech around crypto has made very large progress and new competitors have entered the market. Few, though, have been as successful as Solana – one of the top players in the layer-1 segment. With up to 65,000 TPS and ultra-low fees, the cryptocurrency is a worthy rival for Ethereum. Let’s dive into the market and compare Solana and Ethereum, two leading ecosystems regarding their functionality and investment potential.

Ethereum:- History, Technology and Its Ecosystem

In 2013, Ethereum was proposed by Vitalik Buterin, but Ethereum was launched in 2015, bringing a completely new space just like a twin brother of Bitcoin. The invention revolutionized blockchain by introducing decentralized applications powered by smart contracts – self-executing contracts, written in Solidity, Ethereum’s programming language.

The new technology allows developers to build complex applications on blockchain. As Ethereum developed, it struggled with managing increasing amounts of work, power consumption issues and heavy transaction fees. For a long time, the second-largest cryptocurrency used the energy-intensive proof-of-work (PoW) as a general mechanism of mining, but its limitations became overwhelming.

In 2020, the network began changing to the proof-of-stake (PoS) algorithm as part of the Ethereum 2.0 upgrade 2020, a great improvement in terms of security and energy efficiency. To tackle the workload, the network also adopted several layer-2 solutions, which help in speeding up transactions and lowering fees.

Ethereum has also become a hub for non-fungible tokens (NFTs), where digital assets are traded via smart contract. Beyond that, the platform holds a massive amount of total value locked in decentralized finance (DeFi) applications and plays a critical role in the broader crypto economy.

Ethereum’s biggest strength is its developer community, which consists of working hard to drive innovation and improvements. Ethereum remains a leading blockchain for various applications beyond just cryptocurrency.

Solana in a Brief: History, Technology, Ecosystem

In 2020, Solana coin was launched by Anatoly Yakovenko and his team at Solana Labs. Solana is a high-performance blockchain designed to overcome the limitations of traditional Cryptocurrencies like Bitcoin and Ethereum. Solana introduced a new general agreement mechanism, important to its innovation. The algorithm, called proof-of-history (PoH), allows for rapid transaction validation by creating a historical record of events.

This unique approach of Solana achieved a significant number of transactions, 50,000 transactions per second. This network is able to support a peak capacity of 65,000 transactions, making it the fastest blockchain there.

The Solana ecosystem has grown rapidly, supporting a wide range of dapps and decentralized, web3 services. Its low transaction fees and high speed have attracted numerous projects in the decentralized finance and NFT sectors, further enhancing its appeal.

As of early 2025, the platform boasts substantial total value locked that rose from $1.4 billion to over $10 billion over the past year – an increase of approximately 600%.

Its developer community is also always looking for building using solidity-like programming languages to create new tools and improve existing ones. Solana hasn’t been without its challenges. Network outages and security issues are some drawbacks, but the blockchain remains a top choice in the crypto space, its speed, efficiency, and innovative tech.

Key Features and Differences Between Ethereum and Solana

Both Ethereum and Solana power smart contracts, DeFi, and NFTs – but they take different paths to get there. Ethereum, the best of decentralized apps, prefers security and decentralisation. On the other hand, Solana goes all-in on speed and low fees. One scales with layer-2s, the other with proof-of-history. Let’s explore some key features of Ethereum and Solana.

Consensus Mechanisms

Ethereum currently uses a PoS consensus mechanism as part of its Ethereum 2.0 upgrade, which enhances security and energy efficiency. In PoS, validators are selected to create new blocks based on the amount of cryptocurrency they hold and are willing to stake as collateral. If they act dishonestly, they risk losing their staked assets. The network operates in epochs and slots, validators vote on the validity of blocks, ensuring a secure and efficient process.

Solana, the network employs a unique proof-of-history mechanism in addition to the PoS mechanism. Such a combination enables quick transaction validation by creating a historical record of events.

Transaction Speed

Solana boasts extraordinary transaction speed of 65,000 TPS (transactions per second), and comes from the PoH mechanism. Ethereum traditionally operated on a proof-of-work system, which limited its speed. But with Ethereum 2.0 and adoption of a proof-of-stake mechanism, Ethereum has enhanced its transaction speed, but it still lags behind Solana in raw speed.

Scalability

Both platforms face challenges to manage their increasing workload but address them differently.

Ethereum has implemented layer-2 solutions to improve working capacity by offloading some transactions from the main chain. Which helped reduce network congestion and lower transaction fees. While Solana supports high speed transactions without the need for layer-2 solutions. The network takes its unique runtime to process multiple smart contracts, simultaneously, traditional blockchains execute transactions sequentially, which has obvious negative effects on scalability.

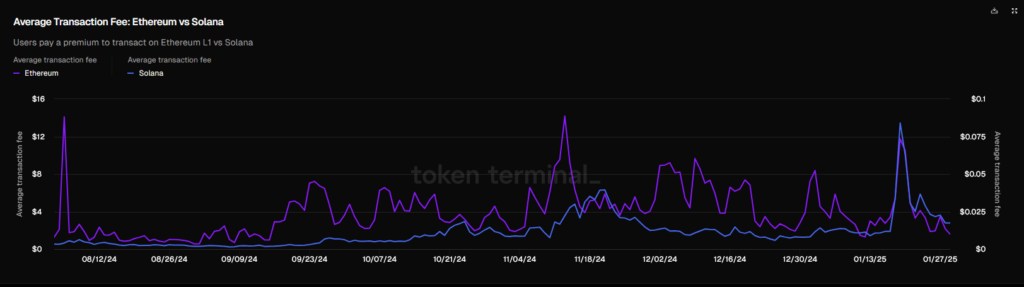

Transaction Fees

Transaction costs on Solana are much lower than those on Ethereum. In the latter network, gas fees can fluctuate dramatically based on the current demand, which results in high costs during peak times. Solana maintains low fees due to its efficient processing capabilities. But in the case of Ethereum, we’re talking about the mainnet. Layer-2 fees are practically as low as Solana’s.

Smart Contracts

Both Ethereum and Solana have a strong smart contract platform, enabling developers to create dapps. Ethereum has a more mature ecosystem with a larger number of existing dapps and a well-established developer community. While Solana is quickly catching up with its attracting projects with its speed and cost effectiveness.

Cross-Chain Transactions

Solana is increasing their focus on enabling cross-chain transactions, allowing for the ability to do work with other blockchains. This feature enhances its effectiveness in the multi-chain future of blockchain technology. Ethereum primarily focused on expanding its own ecosystem, but Ethereum also supported cross chain transactions through various protocols.

Both Ethereum and Solana provide essential functionalities for decentralized applications and smart contracts, but they differ in transaction speed, scalability solutions, transaction fees, and their approach to cross-chain transactions.

Ethereum vs Solana – Key Technical Aspects

Let’s dive deeper in this technical world and take a closer look at the technicalities that make the difference between Ethereum and Solana. Both platforms share similarities but they also face issues like security, decentralization, and tokenomics differently. Here we break down some crucial aspects to highlight technical specs and potential challenges.

Security and decentralisation

After the Ethereum 2.0 upgrade, Ethereum started prioritizing security and decentralization, boasting over a million validators, which enhances its resilience against attacks, including the risk of a 51% attack.

On the other hand, Solana operates with around 2,400 validators, which raises concerns about potential centralization and the possibility of network hacking. Past incidents of network hacking prompted Solana to implement upgrades like Firedancer to improve reliability. While both the networks are looking for security, Ethereum’s extensive validator ecosystem provides a stronger foundation for decentralized applications.

Architecture

On an architectural point, both Platforms differ from each other. Ethereum uses a modular architecture, allowing for the integration of layer-2 scaling solutions to increase transaction throughput while maintaining decentralization. This way supports various decentralized applications and smart contracts without compromising security.

Oppositely, Solana follows a monolithic approach, focusing on high-speed transactions through its proof-of-history algorithm. The mechanism enables impressive transaction speeds.

Tokenomics – Ethereum vs Solana

Ethereum operates on an inflationary issuance model, supporting staking and rewarding participants who validate transactions. Ethereum uses a burn mechanism to reduce its supply and create deflationary pressure. This mechanism permanently removes a portion of ETH from circulation, which can increase its value.

SOL operates with a maximum supply that can increase over time due to its inflationary model. In the starting phase, total supply was set at around 500 million SOL, but in January 2025, it reached approximately 593 million SOL, with around 486 million in circulation. The network issues new tokens each year based on an inflation rate.

Currently, Ethereum ranks much better on inflation with a 0.6% inflation rate vs SOL’s 4.8%.

Key Limitations of Ethereum and Solana Blockchains

Solana has lower fees and faster transaction speeds than Ethereum, but it has some limitations in decentralization and scalability. Solana can process thousands of transactions per second, while Ethereum handles fewer.

Solana’s fees are typically a fraction of a cent, while Ethereum’s can be several dollars. Still, Solana continues to develop cutting-edge features like state compression for enhanced security and cross-chain capabilities through tools like Jupiter, aiming to get ahead of Ethereum.

Ethereum vs Solana – Investment Perspective

Choosing between Ethereum and Solana can be a very tough call because both Ethereum and Solana are strong investment assets. Ethereum claims a strong ecosystem and widespread adoption, while Solana is rapidly gaining ground by offering cost-effectiveness, lightning speed, fast transactions and continuous improvements.

Market Performance Trends

In 2024, Solana performed Better than Ethereum in terms of price growth, with a 122 percent increase compared to Ethereum’s 39 percent rise. This shift was partly attributed to Solana’s strong community engagement and the popularity of meme coins within its ecosystem. But according to recent data, Ethereum is regaining its momentum, leading in price performance with a 27% increase over the past month as of late December 2024.

Market Capitalization and Institutional Adoption

Ethereum continues to dominate in market cap, boasting over 390 billion dollars compared to Solana’s approximately 116 billion dollars. Ethereum also wins on institutional adoption, with significant backing from firms like BlackRock and UBS. However, Solana is seeing growing institutional interest from companies like Visa and PayPal, which could enhance its market presence in the near future.

Ecosystem Developments

Both platforms are developing very fast and continuously. Ethereum provides strong support for real-world asset tokenization and has been a leader in the crypto ETFs sector, including spot Ethereum ETFs that are gaining attraction among investors. Solana is trying to catch up. The network has been actively pursuing Solana ETF applications, which could attract more institutional funds soon.

Community-Driven Governance

Solana’s community-driven governance model has supported a strong user base that actively participates in decision-making processes. This contrasts with Ethereum’s more centralized governance structure, which may appeal to institutional investors looking for stability and reliability.

Inflationary Supply of Solana

Solana’s inflationary supply of SOL tokens can be a double-edged sword. While it offers higher staking yields 7.16% compared to Ethereum’s 3.01%, it also raises fear about long-term value retention as more tokens enter circulation. This aspect may influence investors’ opinion as they weigh potential returns against inflation risks.

Both Ethereum and Solana provide attractive investment opportunities, but align with different investor profiles. Its institutional adoptions and RWA tokenization applications make Ethereum a safer choice for investors. Solana on the other hand appeals to investors looking for high growth driven by community engagement and lower transaction costs.