Bitcoin’s price slipped to a key support level on Sunday as investor appetite waned, tariffs rattled markets, and weak U.S. jobs data raised fresh concerns about economic momentum.

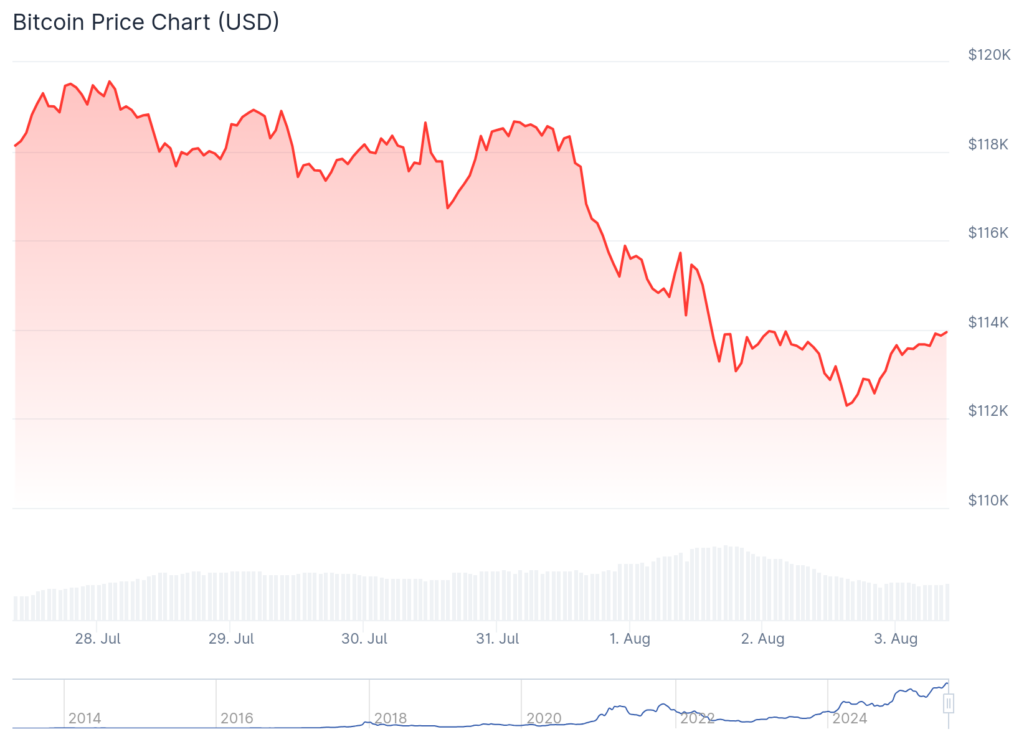

At last check, Bitcoin was trading just below $114,000. That’s down 3.5% over seven days. See below.

Summary

- Bitcoin price crashed to $112,000, down by 8.9% from its all-time high.

- The drop occurred after Trump implemented tariffs on specific countries and following the release of weak jobs data.

- It has formed a break-and-retest pattern, indicating a strong rebound this week.

Bitcoin price crashes as risks rise

Bitcoin’s (BTC) price retreated as demand for spot BTC ETFs declined in the U.S. Data show that spot BTC ETFs experienced a net outflow of over $812 million on Friday, surpassing the $114 million recorded a day earlier.

The weekly data shows that demand among investors has been in a downtrend. These funds experienced a net inflow of $2.72 billion in the week of July 11, followed by a decrease to $2.39 billion in the subsequent week.

Bitcoin ETF inflows then slowed by $72 million in the week of July 25, followed by net outflows of $643 million last week.

Trump fires messenger as BTC breaks

Bitcoin price also dropped after President Donald Trump announced tariffs on key countries last week. The U.S. will charge a tariff of at least 15% on all imported goods, putting the American and global economy at risk of a slowdown.

The impact of Trump’s trade war became apparent last week when the U.S. released weak jobs data. In a report, the Bureau of Labor Statistics (BLS) revealed that the U.S. economy added only 73,000 jobs in July. That’s much lower than the expected 110,000.

The BLS also downgraded the estimate of the recent numbers. This revision implied that the economy created just 35,000 jobs in the last three months, the smallest increase since 2020.

Trump promptly fired BLS commissioner Erika McEntarfer.

William Beach, a 2017 Trump appointee and McEntarfer’s immediate predecessor at BLS, rebuked Trump’s decision. “The totally groundless firing of Dr. Erika McEntarfer, my successor as Commissioner of Labor Statistics at BLS, sets a dangerous precedent and undermines the statistical mission of the Bureau,” Beach wrote on social media.

The tariffs and the weak jobs data explain why the stock and crypto markets pulled back last week.

Bitcoin price technical analysis

The daily timeframe chart shows that Bitcoin price peaked at $123,200 last month and then retreated to $112,000 on Sunday. Its lowest level was notable as it confirmed the highly bullish break-and-retest chart pattern.

A break-and-retest is a popular continuation pattern that happens when an asset makes a breakout above a resistance level and then retests it. In this case, $112,000 was a key level as it was the highest point in May this year and the previous all-time high. It also coincided with the 50-day moving average.

Therefore, Bitcoin price will likely bounce back later this week as long as it remains above the support at $112,000. A crash below that level may see it fall to the 100-day moving average at $107,890.