Healthcare and finance might seem like entirely different fields, but Eric Semler, Chairman of Semler Scientific, sees a striking connection between the two. Both are about preventative care, “We want to be about financial and medical freedom,” Semler explains.

“Our healthcare business is about early detection—helping people avoid disease rather than treating it after the fact. And the more successful we are at that, the more cash we generate to buy bitcoin.”

As Chairman, Semler has led the company’s dramatic pivot into bitcoin as a treasury reserve asset, a move that has sparked debate across Wall Street and the Bitcoin community.

“We’re probably the most leveraged stock play on bitcoin,” he says, referencing Semler Scientific’s bold approach to increasing its holdings.

Founded in 2007, Semler Scientific (NASDAQ: SMLR) initially built its reputation with QuantaFlo®, a rapid point-of-care test for diagnosing cardiovascular conditions like peripheral arterial disease (PAD).

While its medical technology has gained recognition, it’s the company’s bitcoin strategy that is turning heads at the moment.

Since its first purchase of 581 BTC in May 2024, Semler Scientific has more than tripled its holdings to 3,192 BTC, which equates to over $300 million dollars at the time of writing.

A Year of Growth and Bold Moves

“2024 was a transformative year for Semler Scientific as we embraced a Bitcoin treasury strategy to maximize stockholder value,” Semler states. The numbers back it up.

The company has generated an impressive BTC Yield of 107% since July 2024, a key performance metric they use to assess their bitcoin acquisitions.

BTC Yield tracks how much their bitcoin per share has grown, showing how efficiently they’re adding bitcoin, even when issuing new stock or debt to fund it.

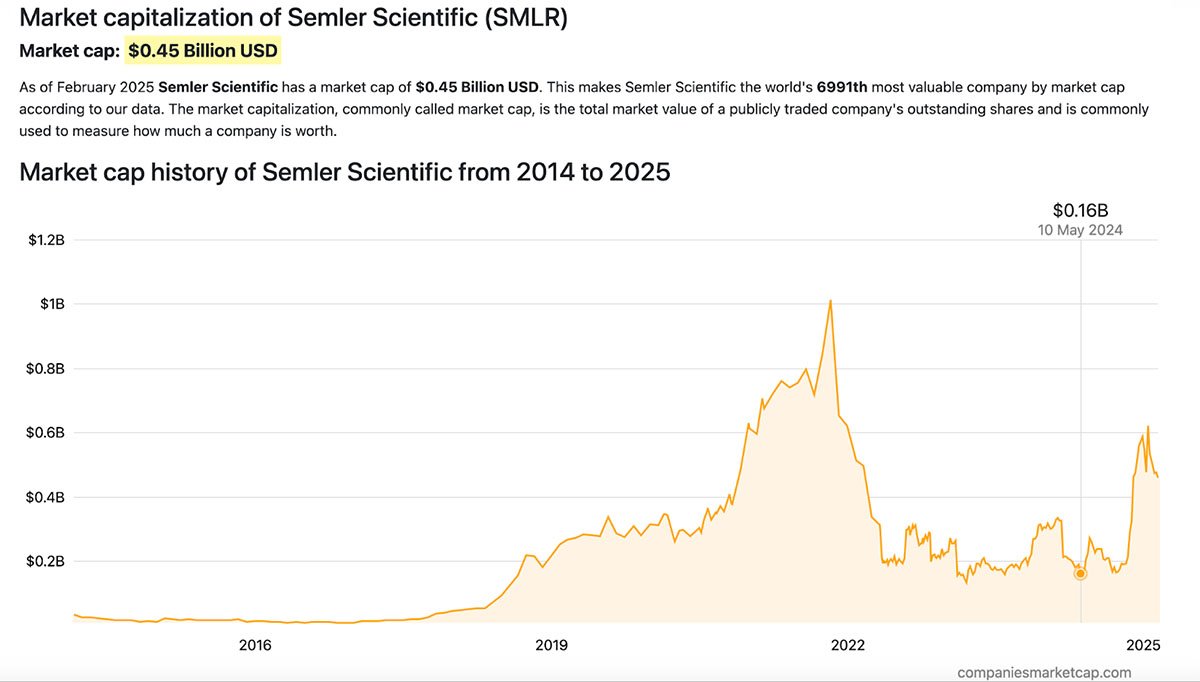

Their market capitalization has surged around 200% since launching this strategy. “My main focus is on helping Semler increase its bitcoin holdings” Semler proudly notes.

The Zombie Company Playbook

Beyond building Semler Scientific’s Bitcoin stockpile, Semler has taken on a side project: calling out so-called “zombie companies.” These are profitable businesses sitting on large cash reserves but doing little to grow.

“There’s a whole ocean of them,” Semler says. “Companies that haven’t performed for years, tried buybacks, tried acquisitions, and are just stuck in a rut.” His goal? To wake them up and show them that embracing bitcoin could be their ticket to transformation.

Though Semler is passionate about rousing these “zombie companies” from their stagnation, he concedes it’s a tough sell.

“The desire to do it is not as high,” he admits, adding, “It surprises me, especially with the repeal of SAB 121, which just makes custody less of a headache.”

This regulatory shift eases bitcoin custody for corporations, yet traditional finance leaders remain lukewarm, something Semler expects will start to shift as major banks step into the space as custodians.

The Power of Leverage

Like Strategy, Semler Scientific has embraced an aggressive bitcoin-buying strategy, but with a bolder twist: more leverage.

“We recently did a $100 million convertible offering,” Semler explains, “so if bitcoin does go up a lot from here, we should go up a lot more, just because of the concept of leverage in finance.”

This aggressive treasury strategy positions Semler Scientific as one of the most leveraged bitcoin players in the market.

Such risk isn’t for everyone, but Semler remains unfazed. “I agree bitcoin is volatile,” he says, though he notes, “you could probably argue that it’s gotten less volatile as it’s become more institutionalized.”

He frames volatility as a strength: “Anytime you have a new asset class or investment trend—like AI or the internet or mobile phones—there’s always volatility in the early stages. You can’t have great, outsized returns in these types of emerging trends without volatility.”

For Semler, it’s a calculated trade-off: “If you’re expecting to make big returns, you’ve got to be willing to handle the volatility.”

A Future Beyond Just Holding Bitcoin?

Given the company’s aggressive bitcoin strategy, does Semler see a future where it follows Strategy’s rumored path toward becoming a bitcoin-native financial institution?

Not quite. “We need to forge our own path,” he says.

“For us, it’s about financial and medical freedom. Our healthcare business is about early detection—helping people avoid disease rather than treating it after the fact. And the more successful we are at that, the more cash we generate to buy bitcoin.”

It’s a symbiotic relationship that Semler believes will only strengthen over time. “Preventative healthcare saves billions in costs, and Bitcoin preserves financial sovereignty. We see them as complementary forces.”

If Eric Could Ask Satoshi One Question…

Near the end of our conversation, I asked Semler a question I love posing to Bitcoin leaders: If you could ask Satoshi Nakamoto one question, what would it be?

After a thoughtful pause, he answered, “I’d ask if he’s surprised by how successful Bitcoin has become.”

It’s a fitting question from a man whose company is riding Bitcoin’s rise: a force not just fueling a peaceful financial revolution, but Trojan-horsing its way into corporate balance sheets and strategies.

Semler sees it transforming stagnant zombie companies into dynamic, profitable players, a tide that could lift many ships toward abundance.

The Bottom Line

Semler Scientific’s embrace of Bitcoin is bold, calculated, and, in Semler’s own words, “a no-brainer.” With a healthcare business generating cash flow and a bitcoin strategy designed to maximize long-term value, the company is redefining what it means to be a dual-mission business.

Semler puts it succinctly: “We’re thinking about adopting a motto: ‘Medical and Monetary Freedom for Semler Scientific.’” In an era where both financial uncertainty and rising healthcare costs erode personal freedom, Semler Scientific is taking an unconventional but calculated approach.

“Preventative care in medicine saves lives and cuts costs. In finance, Bitcoin does the same—protecting wealth and ensuring long-term security. We believe in both,” he emphasizes.

By aligning its healthcare innovation with a Bitcoin-first treasury strategy, Semler Scientific has a bright orange future.