Standard Chartered’s head of digital assets research, Geoffrey Kendrick, just raised his XRP price target to $8 by 2026, implying a +330% jump from its recent $1.86 price. XRP USD barely moved on the headline, which shows that many traders still treat bank research as background noise, not a buy signal. But when a major global bank starts modeling XRP USD Price years out, it tells you something about how far crypto has moved into mainstream finance.

This call comes after Ripple’s long legal battle with the SEC ended and as fresh XRP exchange-traded funds (ETFs) draw in over $1Bn in the US. Kendrick ties his target directly to this new regulatory clarity and ETF demand.

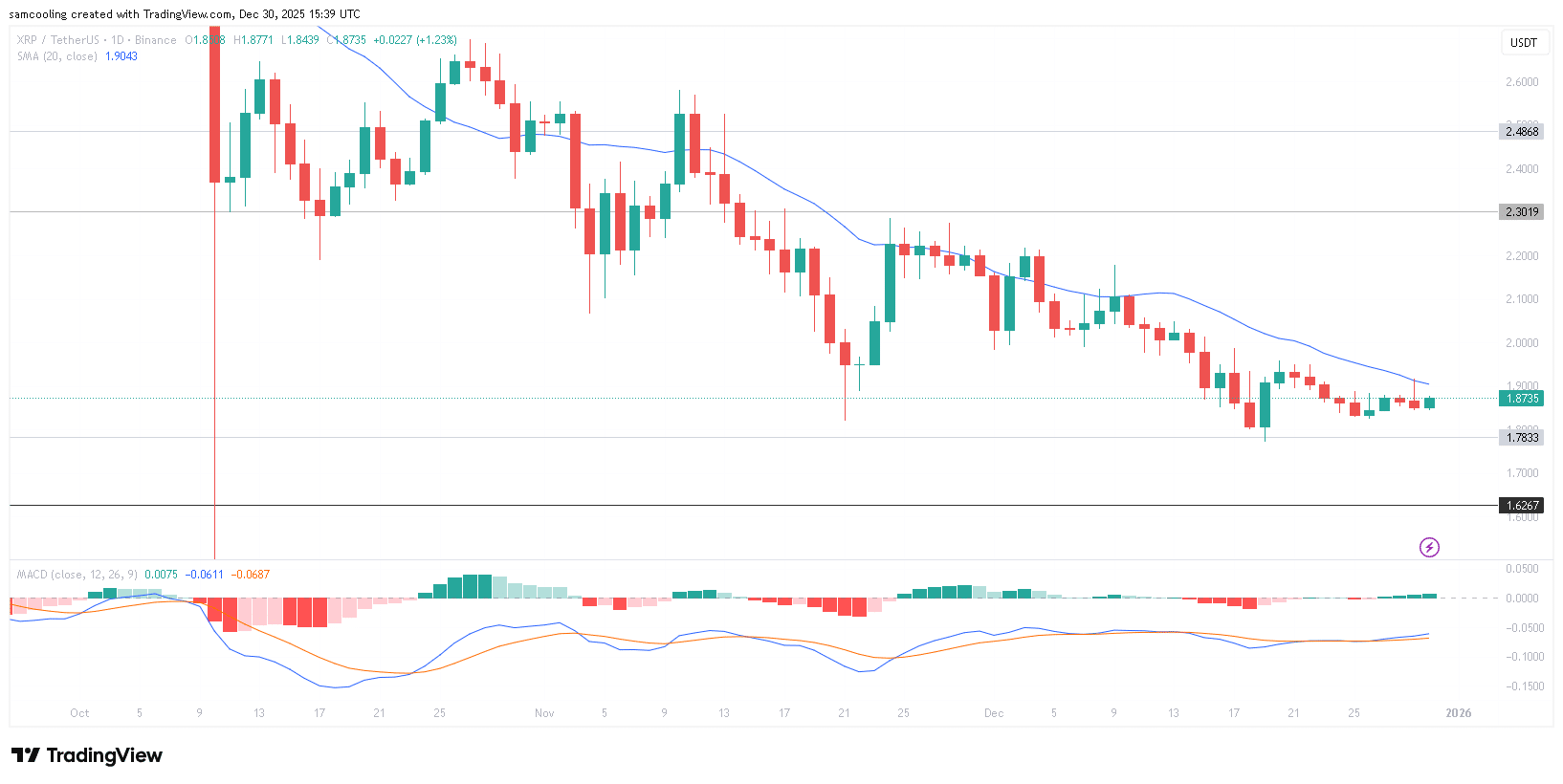

But while Kendrick looks to 2026, the ‘now’ is messier. Even with record ETF inflows, the Moving Average Convergence Divergence (MACD) is beginning to show a bearish divergence. This means that despite the bank hype, the market might need to flush out the ‘weak hands’ toward lower support before Kendrick’s $8 story can truly begin.

(Source – TradingView, XRP USD)

So, for regular investors, the question is not “Will XRP price hit $8?” but “How should I treat bold forecasts like this without gambling my rent money?”

Why Is a Big Bank Suddenly So Bullish on XRP?

First, a quick refresher. Ripple is a company that develops payment software for banks and remittance firms, and XRP is the token that serves as a bridge currency to facilitate quick and cost-effective money transfers across borders. Think of XRP as the “oil” inside Ripple’s payment engine: customers do not always see it, but it helps the machine run faster than old-school bank rails.

The SEC sued Ripple in 2020, arguing that XRP sales were illegal securities offerings. A US court later ruled that XRP sales on exchanges to retail traders did not constitute securities transactions, while some institutional sales did violate securities rules. That split decision removed the “XRP is definitely an unregistered security” cloud for most secondary-market trading, and in 2025 the SEC ended its appeal effort, which cleared the path for U.S. spot XRP ETFs.

Spot XRP ETFs matter because they let traditional investors buy XRP exposure in a stock-like wrapper. US XRP ETFs already attracted about $1.14Bn in net inflows by late December. We covered this institutional demand shift in more detail in our XRP ETF inflows explainer, where XRP funds outdrew some Bitcoin and Ethereum products.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

How Could Standard Chartered’s XRP Forecast Affect Regular Investors?

Standard Chartered already made aggressive calls on other coins, including high long-term targets for Ethereum. Now, it applies the same long-range lens to XRP, with earlier notes flagging $5.50 for 2025 and $8.00 for 2026, as noted here. When big banks spend research time on a coin, it signals that their clients—funds, family offices, even corporates—ask about it.

Under the hood, XRP use in payments has grown. RippleNet works with 300+ financial institutions, and about 40% of them use XRP for On-Demand Liquidity, which is Ripple’s feature for instant cross-border settlement. We broke down how this payment rail works in our guide to Ripple’s XRP payments, where Ripple disclosed more than $15 billion in ODL volume in 2024, with Asia-Pacific leading the charge.

At the same time, new products continue to be added to the XRP Ledger. Ripple’s RLUSD stablecoin grew its market cap by over 300% in Q1 2025, and institutions started testing tokenized treasuries and digital commercial paper on XRPL, according to Ripple. That does not guarantee price performance, but it shows that XRP now lives in a very different world than during the early “just a speculative altcoin” days.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

What Are the Risks Behind a 330% XRP Price Target?

Bold bank calls excite traders, but they also tempt beginners into overexposing themselves. XRP still trades like a high-beta altcoin: it often falls harder than Bitcoin on bad days and overshoots on good days. We covered how violent those swings get in our piece on XRP price swings and manipulation claims.

There is also a real debate around XRP’s long-term value. Some analysts argue that banks can utilize Ripple’s software without the XRP token, or that competing payment networks and stablecoins will erode XRP’s niche. Others question whether Ripple’s large token holdings cap upside. For a reality check on the utility debate, see our article on the XRP utility argument, which examines both the enthusiasm and skepticism surrounding it.

If you already hold XRP, this Standard Chartered forecast does not mean “diamond hands to $8.” Instead, treat it as one bullish scenario from one institution. If you have no position, treat XRP like any risky altcoin: never invest money you need for bills, expect large drawdowns, and size positions so a 70–80% drop would sting but not wreck your life.

The healthy move now is to watch how ETF flows, real-world payment volumes, and new XRPL products evolve over the next 12–24 months. If usage and institutional interest continue to grow, the market will not require a bank report to re-rate XRP.

DISCOVER: Top 20 Crypto to Buy in 2025

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

The post Standard Chartered’s $8 XRP Call: Bullish Signal or Hype Risk? appeared first on 99Bitcoins.