Key Points:

- Definition of Altcoins:

Altcoins refer to any cryptocurrencies alternative to Bitcoin, including popular coins like Ether, Litecoin, and Dogecoin. - Shifting Market Metrics:

According to Ki Young Ju of CryptoQuant, Bitcoin dominance is no longer the defining metric for altseason—instead, altcoin trading volume (currently 2.7 times that of Bitcoin) is key. - Traditional vs. Current Dynamics:

Historically, altcoin movements were driven by capital rotation from Bitcoin. Now, stablecoin liquidity flows play a pivotal role in shaping the altcoin market. - Selective Altseason:

Only a few altcoins are displaying a true bullish dynamic, suggesting a selective market environment where not all altcoins benefit from the new liquidity trends. - Bitcoin’s Separate Ecosystem:

With the rise of Bitcoin ETFs and institutional investments, Bitcoin is operating in its own paper-based ecosystem, decoupling its historical price correlation with altcoins and paving the way for independent trends in the altcoin market.

Altcoin refers to any alternative cryptocurrency to Bitcoin. They often share code and functionality and include coins such as Ether, Litecoin, and Dogecoin. The number of altcoins listed in cryptocurrency markets is rapidly multiplying, and they can be changeable.

Altcoins are becoming famous around the world, but this time the story seems different. From Historical background we can say that each altcoin is triggered by a rotation of capital from Bitcoin to alternative cryptos, leading to a widespread Market Change.

This Altseason Is Different

According to Ki Young Ju, CEO of Crypto Quant, this cycle may change. Ki Young claims that the current dynamics do not depend on a flight from Bitcoin dominance, but on liquidity flows from stablecoins. An expected situation that never happened before could redefine the path of the crypto Market.

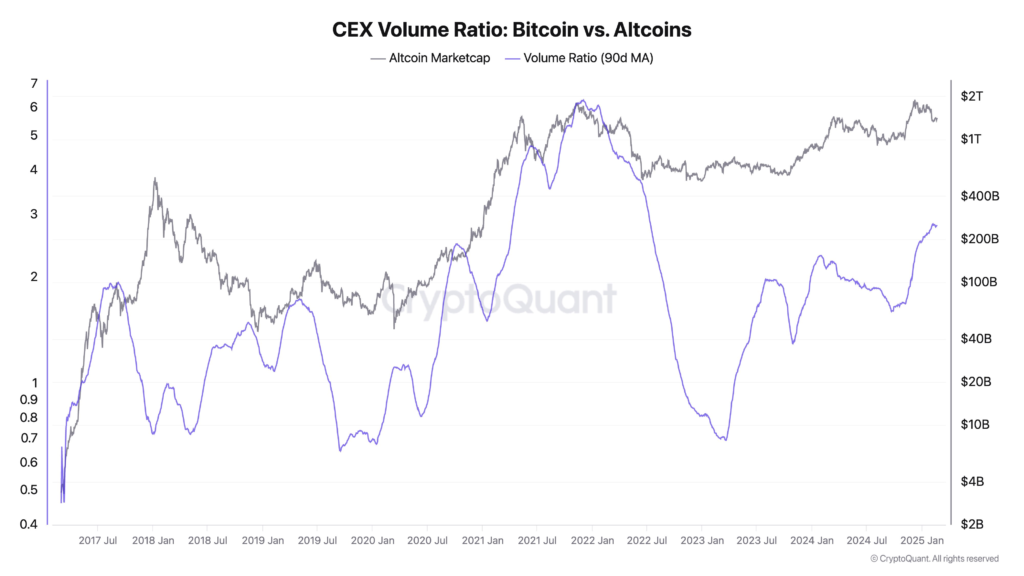

Ki Young Ju’s statement represents a major change in the understanding of crypto cycles. Ki Young explained this on his social media platform X “Bitcoin dominance no longer defines altseason. It is now the trading volume that matters,” Alt volume is 2.7x BTC.

In reality, unlike previous patterns, investors shifted their profits from Bitcoin to altcoins. Today it is stablecoin holders who are injecting liquidity into the market.

Observations confirm this figure that altcoins volume is 2.7 times that of Bitcoin, which indicates that it reflects a renewed interest in these altcoins. However, this dynamic does not affect the whole market.

Ki Young CEO of CryptoQuant on platform X said that it is a “very selective altseason” where “only a few altcoins show a true bullish dynamic.” Thus, the absence of new fresh capital could limit the extent of the movement and prevent a widespread rise.

The crypto market is going through a period of tension, and the numbers speak for themselves. While Bitcoin is moving in a zone of uncertainty.

The Entry of Bitcoin Exchange-Traded Funds (ETFs)

The rise of Bitcoin ETFs and acquisition of the assets by institutions have changed the game. Now, Bitcoin operates in a different environment, different from that of altcoins.

Bitcoin is drifting away from the crypto ecosystem. Bitcoin has built its own paper-based Layer 2 ecosystem through ETFs, MSTR, funds, and more. In this paper-based L2 Bitcoin, bridging to other altcoins is impossible.

Altcoins used to move together based on their correlation with BTC, but that pattern has now broken. Only a few are starting to show independent trends as they attract new liquidity.