Many Crypto influencers claimed that the WazirX crypto exchange is creating pressure on the WazirX creditors in advance to get support for their restructuring scheme.

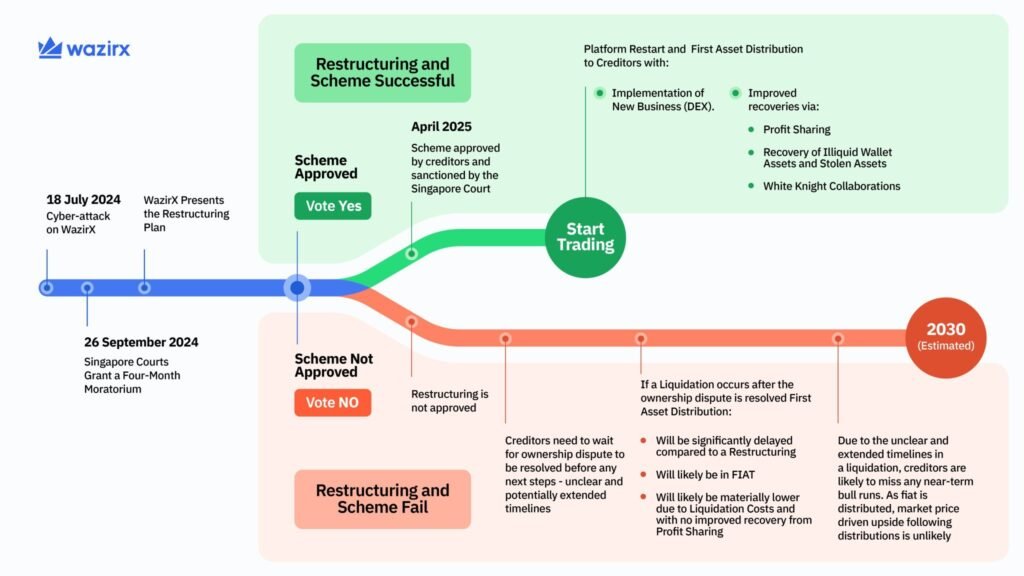

WazirX, once India’s top cryptocurrency exchange, has been struggling badly for the last year. In a hacking incident on 18 July 2024, the exchange lost nearly 45% of the customer’s funds, since then services of this platform have been suspended. Currently, WazirX leadership is working to conduct the vote event to get support from the WazirX customers to restart the service again by getting authority from the court.

The exchange has given creditors two options—either vote “Yes” to approve the restructuring plan or “No”, which could lead to liquidation. Some crypto influencers shared their opinion & claimed that the exchange is indirectly manipulating creditors into choosing “Yes” by highlighting the negative consequences of rejecting the plan.

The WazirX team is currently working to conduct the vote event to allow WazirX customers to step with the exchange’s official restructuring roadmap, where creditors have two choices:

- Vote “Yes” (Restructuring Scheme Approved)

If the majority of the creditors vote “Yes”, then the platform will be live for trading funds in April of this year, and also another new crypto platform will be launched to increase the exchange’s revenue to compensate the customers.

Also, the creditors will benefit from improved recovery through profit sharing, recovery of stolen/illiquid assets, and collaborations with financial backers.

- Vote “No” (Scheme Not Approved)

If the majority of the creditors vote for “No”, then the restructuring scheme plan will be rejected, and the court will not allow exchange to step with the restructuring scheme.

Notably, the exchange clearly mentioned in the roadmap that the decision against the restructuring process will extend the exchange’s struggle indefinitely for the resolution before receiving any assets.

As per provided information by the Wazirx team on the roadmap, shared on X (formerly Twitter), If liquidation occurs, asset distribution will take significantly longer and will likely be in fiat (cash) instead of crypto and also there are huge chances that customers will receive very low payouts due to high liquidation costs and the lack of profit-sharing opportunities.

Are Creditors Being Pressured Before the Vote Process?

Many WazirX customers, including crypto influencers, noted that the exchange has heavily emphasized the negative consequences of voting against restructuring plans, effectively imposing pressure on the creditors to vote “Yes.”

Experts noted that the WazirX leaders are portraying platform liquidation as a worst-case scenario with long delays, uncertainty, and lower returns.

Some people noted that the roadmap does not highlight potential risks associated with the restructuring, such as the failure of a new business model or challenges involved in the asset recovery.

So by asserting the benefits of voting “Yes,” some WazirX creditors feel that WazirX leadership is following a well-planned approach to get favour for itself planned decision that primarily benefits WazirX’s management.

WazirX token price action

Following this news, the majority of the crypto traders are optimistic about the exchange’s future plan, which can be seen with the increase in the trade price of $WRX, the native token of the exchange.

The current trade price of $WRX is $0.026 & this price level is +6.5% high over the last 24 hours trade period.