- The surge in XRP Ledger payment transactions comes with the integration of stablecoins like RLUSD and USDC, which have enhanced XRPL’s role in low-cost, cross-border settlements.

- XRPL’s native support for tokenization, fast finality, low fees, and compliance-friendly design has made it an attractive choice for enterprise use.

Ripple XRP Ledger is currently undergoing a new phase of expansion, with the ultimate goal of becoming a high-speed, low-cost payment network while gaining momentum in decentralized finance (DeFi) and tokenization use cases.

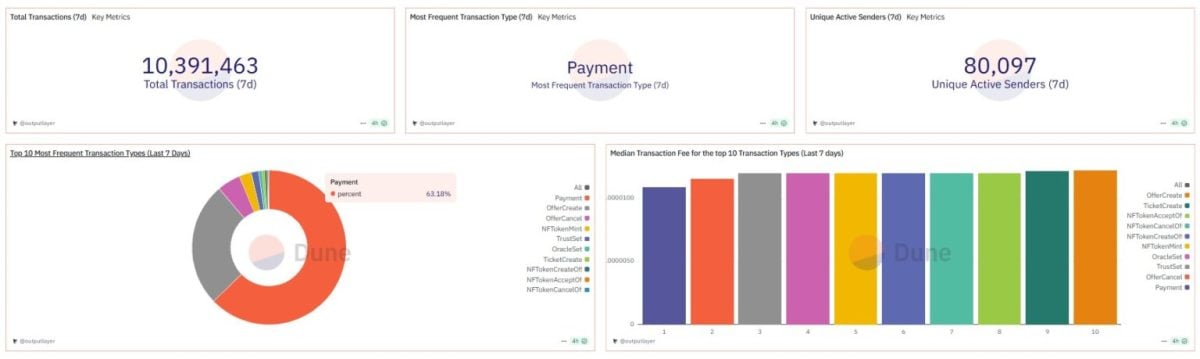

The latest data from DuneAnalytics shows that the weekly payment transactions on XRPL have surged by a massive 430% in the last two years, now topping 8 million so far in 2025. These transactions now make up nearly two-thirds of all on-chain activity, underscoring XRPL’s continued dominance as a settlement layer for fast, affordable cross-border transfers.

These massive growth numbers for XRP Ledger come from its core strengths, such as minimal fees, rapid transaction finality, and native support for tokenizing real-world assets. Its built-in compliance features have positioned XRPL as a compelling choice for enterprise and institutional adoption.

A key driver behind the recent surge in activity is the integration of stablecoins. Ripple’s RLUSD and Circle’s USDC have gained momentum on the network, alongside newcomers like EURØP, USDB, and XSGD. As a result, the utility for XRP Ledger has expanded further, especially in the area of cross-border payments.

Institutional interest is also rising. The European Central Bank has reportedly explored leveraging XRP in distributed ledger-based payment systems.

Growing Role of XRP Ledger In DeFi

Moreover, with the total locked value (TVL) of $60 million, XRP Ledger is currently emerging as a dominant player in the decentralized finance (DeFi) space.

While the total value locked on XRP Ledger remains modest compared to Ethereum’s multi-billion-dollar ecosystem, XRPL developers maintain that the network serves as a foundational layer for blockchain innovation. Speaking on the development, Panos Mekras, co-founder of Anodos Finance, a leading XRPL-based DeFi platform, said:

The XRP Ledger pioneered most of the properties we now take as granted in the space. From deflationary tokenomics and burning, to DeFi features and DEXs, tokenization, payments, and more. This is the OG that started DeFi and most in the industry don’t know about it.

Dune Analytics highlights that the XRP Ledger (XRPL) hosts one of the longest-running decentralized exchanges, uniquely powered by a native order book instead of smart contracts. The DEX also features tools like auto-bridging and native liquidity pools that have helped maintain its functionality over the years.

As reported by CNF earlier, Ripple recently launched a new Permissioned Decentralized Exchange (DEX) on the XRP Ledger, allowing regulated entities to trade within a controlled environment

However, adoption remains relatively limited. XRPL’s DEX averages just 2,300 daily traders, significantly trailing Uniswap’s 10,000 daily active addresses, according to data from earlier this year.

That dynamic could shift soon. A series of recent upgrades, including the rollout of an Ethereum Virtual Machine (EVM)-compatible sidechain, aims to attract Ethereum-native decentralized applications to the XRPL ecosystem, potentially boosting its usage and relevance in DeFi.